Sat 12 October 2024 ▪

4

min reading ▪ acc

Tether, after ten years as a leader in stablecoins with its famous USDT, is entering a maturity phase. The company is celebrating its journey by unveiling a documentary that traces its global impact. Titled “Stability and Freedom in Chaos,” this film highlights the massive adoption of stablecoins in countries struggling with soaring inflation. Target? Show how crypto USDT has become a real shield against economic volatility.

Since 2014, Tether news has been shaking up the cryptocurrency market. With the idea of Brock Pierce and his acolytes linking the digital currency to the dollarthe stablecoin USDT was born. Their goal? Delivering stable value to an ever-changing financial world. In other words, to fight financial instability. As a result, Tether is now a key player in the crypto ecosystem.

over the years USDT has integrated into many blockchainslike Ethereum (ETH) and TRON (TRX) – our view on Tron, multiplying its use in decentralized platforms.

Traders, always looking for stabilityquickly switched to this stablecoin. USDT has become a safe haven for them in a volatile market.

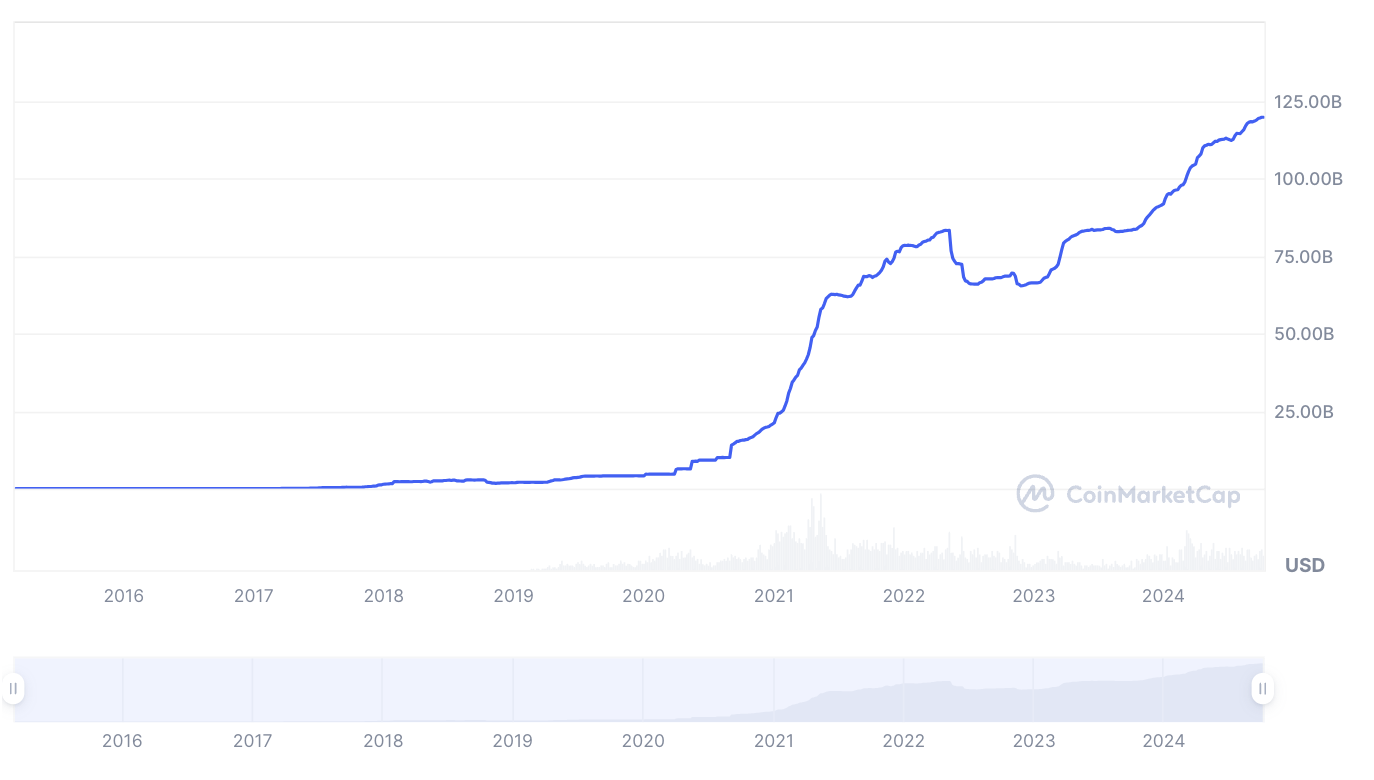

And with capitalization flirting with 120 billion dollarsTether remains a titan in the crypto arena.

Crypto USDT Key Role Against Inflation

USDT not only established itself in the crypto world, but also created it emulators in countries facing skyrocketing inflation. This is the case in Argentina, Brazil and Turkey, three countries where economic instability has become the norm.

Faced with a collapsing national currency, many are turning to stablecoins protect your purchasing power.

- In Argentina, inflation has exceeded 100% since 2023;

- In Türkiye, the devaluation of the pound is a disaster for savers;

- In Brazil, a large number of citizens do not have access to traditional banks.

In this context, crypto USDT seems to be the solution to circumvent the crisis. ” Tether is a life saver », says Paolo Ardoino, CEO of the company, reminding us that the impact of the stablecoin goes far beyond trading.

Tether and its gray areas despite its development

If Tether has won the hearts of users, its journey has not been without hiccups. The company often faces criticism lack of transparency of its reserves. Many point to the lack of regular independent audits, which calls into question the strength of the financial guarantees that support the USDT.

Additionally, Tether has been accused of repeatedly manipulate the Bitcoin (BTC) market. However, these reproaches did not stop the company from prospering, as evidenced by the release of its documentary. It also reflects these gray areas and reaffirms them at the same time Tether’s commitment to provide a stable solution to an ever-changing world.

With 5.2 billion in profit in the second half of 2024, Tether continues to outperform financial giants such as BlackRock. Ten years after its inception, the company not only withstood the crises, but emerged stronger than ever.

Maximize your Cointribune experience with our “Read and Earn” program! Earn points for every article you read and get access to exclusive rewards. Register now and start reaping the benefits.

The blockchain and crypto revolution is in full swing! And on the day the effects are felt by the most vulnerable economy in this world, I will say against all hope that I had something to do with it

DISCLAIMER OF LIABILITY

The comments and opinions expressed in this article are solely those of the author and should not be considered investment advice. Before making any investment decision, do your own research.